The Only Guide to Hiring Accountants

The Only Guide to Hiring Accountants

Blog Article

Little Known Facts About Hiring Accountants.

Table of Contents3 Simple Techniques For Hiring AccountantsHiring Accountants Fundamentals ExplainedNot known Factual Statements About Hiring Accountants The 45-Second Trick For Hiring AccountantsThe Facts About Hiring Accountants Revealed

Depending on the dimension of your organization and the services you require, the rate will certainly differ. While this is one more cost to add to your business costs, a payroll accounting professional can soon finish up paying for themselves.While you do not obtain somebody functioning solely for your group, outsourcing likewise has great deals of its own advantages. It is frequently an extra affordable option than employing a person in-house, particularly for small to medium-sized business (SMEs) that might not call for a full time payroll manager - Hiring Accountants. Costs here can vary from a couple of hundred to numerous thousand pounds each year, depending on the degree of service called for

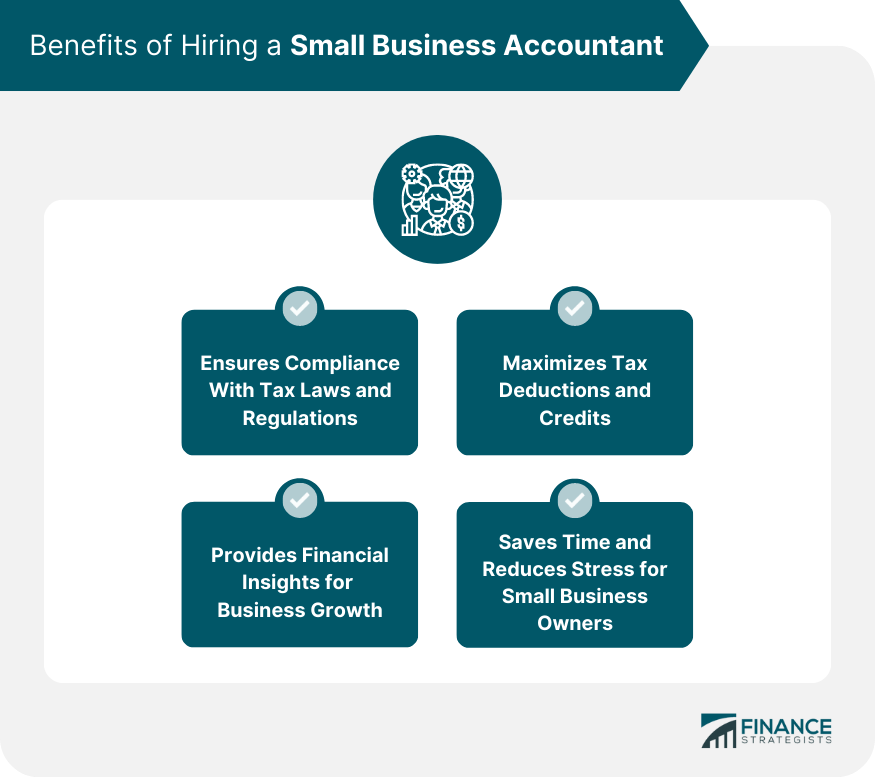

The UK's tax obligation system, especially pay-roll tax obligations, is intricate and subject to constant modifications. A payroll accounting professional makes sure that your company remains certified with HM Profits and Customs (HMRC) policies, therefore avoiding possible fines and legal problems. The tranquility of mind and security this gives can be important. This can additionally assist to conserve you money in the long run.

The Single Strategy To Use For Hiring Accountants

The moment spent by entrepreneur or other team member on payroll can be substantial. If you function out the hourly spend for a senior participant of staff and include up the moment they are investing in pay-roll administration, it usually can be much greater than the cost of outsourcing.

This strategic input can result in substantial price savings and performance gains gradually. This is where this specialist advice really comes into its own and can give substantial advantages. Just having an expert sight and somebody to discuss your pay-roll with you can result in far better decision-making and a much extra enlightened procedure.

Buying a pay-roll accountant or solution can save companies money in the future. By guaranteeing compliance, avoiding fines, saving time, and offering calculated insights, the expense of working with a pay-roll accounting professional can be offset by the financial and non-financial benefits they bring. While the very first time duration may set you back greater than you receive, you can be confident that what you are doing is profiting your company, helping it grow, and worth every penny.

Some Of Hiring Accountants

Scott Park, CERTIFIED PUBLIC ACCOUNTANT, CAFor most organizations, there comes a factor when it's time to hire an expert to handle the monetary feature of your service operations (Hiring Accountants). If you go to this point in your organization, after that congratulations! You have actually expanded your business to the phase where you must be handing off a few of those hats you use as a local business owner

If you're not an accounting professional how will you recognize my explanation if you're asking the right accountancy details inquiries? For virtually every business out there these days, it seems that one of the largest challenges is finding, working with, and training brand-new workers.

By outsourcing your audit, you're not just obtaining one person's proficiency. You're getting the cumulative brain-power of the whole audit firm. You're getting the background and capability of their personnel, which is a very useful resource of expertise. This certainly is available in helpful when you face an especially challenging or remarkable circumstance with your business.

This will certainly stay clear of unneeded rate of interest and charge charges that may happen when things are missed out on or submitted late. Also, a CPA accountancy company is called for to keep a particular degree of specialist development and they will certainly be up to date on one of the most current tax modifications that take place every year.

Hiring Accountants Things To Know Before You Buy

web site give info of a general nature. These article must not be thought about certain recommendations given that each individual's individual economic scenario is special and reality particular. Please call us prior to carrying out or acting on any one of the details consisted of in one of our blogs. Scott Park & Co Inc.

Lots of services get to a place in their growth where they need somebody to take care of the business funds. The concern then comes Click Here to be not, "Do we need an accountant?" Rather, "Should we contract out or bring someone onto the team to offer audit solutions for our business?" There can be advantages and drawbacks to every and what you determine will ultimately depend on your certain business needs and objectives.

Our Hiring Accountants Statements

When tax season is over, the bookkeeping department published here slows down significantly. During these sluggish times, an in-house accountant will still be on income and coming right into the workplace each day.

You'll need to spend for the software required for an internal accountant to complete their work in addition to the furniture and materials for their work space. An accounting company will certainly already have all these programs, and they'll constantly have the current memberships of the most desired software program. Their group will be appropriately trained and will certainly obtain any essential training on all updated software application.

Report this page